Transportation Management System Market – Global Trends, Growth Outlook, and Strategic Insights (2024–2030)

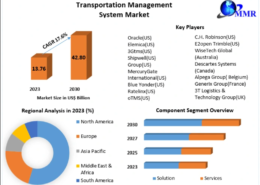

The Transportation Management System (TMS) Market, valued at US$ 13.76 billion in 2023, is projected to surge to US$ 42.80 billion by 2030, expanding at a strong CAGR of 17.6% during the forecast period. As global logistics operations become more complex and demand agile and automated systems, TMS solutions have evolved into a critical part of modern supply chain infrastructure.

Market Overview

A Transportation Management System (TMS) functions as a specialized component of supply chain management and is often integrated within broader ERP ecosystems. A new advanced form, TWMS (Transportation and Warehouse Management System), merges TMS and WMS capabilities into a single platform—removing the need for custom integrations and offering unified visibility and control across logistics and warehouse workflows.

With rising automation, increasing transportation costs, and escalating customer expectations, organizations worldwide are adopting TMS solutions to gain:

- Enhanced visibility of shipping operations

- Improved route optimization

- Operational efficiency

- Real-time decision-making

- Cost reduction in logistics management

Moreover, technologies such as IoT, AI, machine-to-machine (M2M) communication, and cyber-physical systems are improving fleet management, route planning, safety monitoring, and logistics optimization.

Click Here to Receive a Free Sample of the Report:https://www.maximizemarketresearch.com/request-sample/7437/

Report Scope and Methodology

The report segments the TMS market by Components, Transportation Mode, Organization Size, Vertical, Deployment Mode, and Region.

A bottom-up approach was applied to estimate market size, using both primary interviews and secondary analysis of annual reports, financial filings, and expert insights. Major companies such as Oracle, SAP, Manhattan Associates, C.H. Robinson, and E2open form the competitive foundation of the market.

Market Dynamics

- Lower Cost of TMS vs Other Logistics IT Systems

The cost of deploying TMS solutions has been decreasing, making it more accessible to organizations of all sizes. Companies often prefer:

- Off-the-shelf TMS software

- Externally hosted or on-demand TMS platforms

On-demand (cloud) solutions have become more popular due to:

- Lower capital expenditure

- Reduced development time

- Easy scalability

Typical cost ranges include:

- Hosted TMS purchase: US$ 100,000 – US$ 1,000,000

- Installation: US$ 20,000 – US$ 450,000

- Annual maintenance: US$ 4,000 – US$ 400,000

Compared to other enterprise logistics systems, TMS stands out as a cost-effective alternative.

- Implementation Barriers and Their Resolutions

Common challenges:

- System incompatibilities

- Implementation delays

- Resistance from leadership

- Insufficient user training

Resolutions include:

- Modifying system architecture to resolve compatibility issues

- Close collaboration with TMS vendors

- Stronger project management practices

- Comprehensive training programs to increase user adaptability

Some organizations still struggle, choosing to accept ongoing limitations instead of investing in optimization.

- Future Growth Opportunities

TMS users typically fall into two groups:

- Organizations with internally developed systems

- Companies using externally hosted/outsourced TMS platforms

The future lies in integrated platforms that unify:

- TMS + WMS

- Order management systems (OMS)

- Supply chain event management systems (SCEM)

ERP and WMS providers continue to acquire or develop TMS capabilities to offer end-to-end supply chain visibility and orchestration.

Segment Analysis

By Transportation Mode

Roadways – Largest Segment (40%+ in 2023)

Growth driven by:

- Rising e-commerce volumes

- Direct-to-consumer (D2C) shipments

- Investments in road infrastructure in emerging economies

Maritime – Growing at 9.4% CAGR

Supported by:

- Government investments in waterway modernization

- Adoption of integrated TMS solutions for port operations

Airways – Fast Adoption

Boosted by:

- Demand for express delivery

- E-commerce players adopting air freight TMS solutions

By Vertical

Manufacturing – Largest Market Share (31% in 2023)

Factors include:

- Increase in industrial facilities in India, Mexico, and SEA

- Growing raw material movement

- Government programs like Make in India

Retail – Significant CAGR of 8.1%

Fueled by:

- E-commerce boom in APAC

- Global players like Amazon, Alibaba, and Walmart optimizing logistics using TMS

By Deployment Mode

On-Premise – 55% Market Share (2023)

Preferred due to:

- Higher levels of data control

- Customization flexibility

- Ability to host on internal servers

Cloud – Fastest Growth (CAGR 7.9%)

Valued for:

- Remote accessibility

- Real-time updates

- Lower licensing and admin costs

- Scalability

Click Here to Receive a Free Sample of the Report:https://www.maximizemarketresearch.com/request-sample/7437/

Regional Insights

North America – Strong Market Presence (CAGR 9.1%)

The region is home to major TMS innovators such as:

- Trimble Transportation

- McLeod Software

- Blue Yonder

- Descartes

- E2open

- Oracle Transportation Management

- SAP TM

Strong logistics and retail sectors continue to drive regional adoption.

Europe – Mature and Competitive Market

Key players include:

- Transporeon (Germany)

- Soloplan (Germany)

- Generix (France)

- Alpega (Belgium)

- TESISQUARE (Italy)

- AndSoft (Andorra)

The region benefits from strong cross-border logistics and EU digital transport initiatives.

Asia Pacific – Fastest-Growing Market (CAGR 9.3%)

Growth drivers:

- Expanding retail and e-commerce ecosystem in China, India, Malaysia, and Singapore

- Government support for intelligent transport solutions

- Increasing manufacturing activities across APAC

Key Players in the Global TMS Market

- Elemica (US)

- 3Gtms (US)

- Shipwell (US)

- Group (US)

- MercuryGate International (US)

- Blue Yonder (US)

- Ratelinx (US)

- oTMS (US)

- Worldwide Express (US)

- Infor (US)

- Transplace (US)

- Manhattan Associates (US)

- C.H. Robinson (US)

- E2open Trimble (US)

- WiseTech Global (Australia)

- Descartes Systems (Canada)

- Alpega Group (Belgium)

- Generix Group (France)

- 3T Logistics & Technology Group (UK)

- nShift (Finland)

- BlueRock Logistics (Netherlands)

- TESISQUARE (Italy)

- SAP (Germany)

- DDS Logistics (India)

- Oracle (US)

Conclusion

The Transportation Management System market is undergoing a major transformation, driven by digitization, automation, and increasing supply chain complexity. Integrated systems such as TMS + WMS, cloud adoption, AI-driven optimization, and IoT-enabled logistics will shape the future of the transportation industry. As organizations strive for resilient, efficient, and transparent supply chains, TMS technology will remain at the core of global logistics modernization.