India Electric Vehicle Components Market: Growth Trends, Drivers, and Forecast (2024–2030)

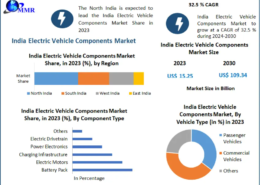

The India Electric Vehicle Components Market was valued at USD 15.25 billion in 2023 and is projected to reach USD 109.34 billion by 2030, growing at an impressive CAGR of 32.5%. The market’s rapid expansion is driven by increasing electric vehicle (EV) adoption, government incentives, and a growing emphasis on domestic manufacturing and sustainable transportation.

Market Overview

Electric vehicles represent a significant technological shift in mobility, powered by advanced components that redefine conventional automotive systems. Key components driving the market include:

- Traction Battery Pack (EVB): Serves as the primary energy storage, powering electric motors. Batteries contribute to 30–40% of EV costs, making them central to market growth.

- DC-DC Converters: Distribute energy efficiently from the main battery to auxiliary systems, ensuring optimal performance.

- Electric Motors: Convert electrical energy into mechanical energy for propulsion, supporting both DC and AC motor types.

- Power Inverters: Enable DC-to-AC conversion and vice versa, regulating speed and enabling recharging functions.

Currently, India relies heavily on imports from China, Japan, and Korea for critical EV components. However, initiatives like the $5 billion PLI scheme are catalyzing domestic manufacturing and innovation in EV technologies.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/63133/

Market Drivers

Environmental Sustainability and Reduced Carbon Emissions

Rising environmental concerns and stricter emission regulations are major growth drivers for India’s EV components market. Electric vehicles, known for zero tailpipe emissions, offer a cleaner and quieter alternative to fossil fuel-powered vehicles. Benefits such as lower operating costs, reduced maintenance, and convenient home charging make EVs economically and environmentally attractive.

The Indian government is actively promoting EV adoption through policies, subsidies, and tax incentives. Programs like the FAME scheme and the National Electric Mobility Mission Plan (NEMMP) aim to accelerate the adoption of EVs and drive local component manufacturing.

Trend: Development of Indigenous EV Technologies

The Indian government’s ‘Make in India’ initiative promotes local innovation and self-reliance in EV technology. This approach reduces dependency on imported components, lowers production costs, and fosters domestic expertise in battery production, electric motors, and power electronics.

Collaborations between startups, research institutions, and global technology partners are driving innovation in EV components, enhancing the country’s technological capabilities and strengthening the domestic EV ecosystem.

Market Restraints

High Initial Costs

Despite advances in technology, the high cost of batteries remains a major restraint. Limited economies of scale and reliance on imports drive up EV prices, making them less affordable for mass adoption. Setting up charging infrastructure, including public and private stations, also requires significant investment, adding to the overall cost burden.

Efforts to scale domestic battery production and optimize local supply chains are expected to mitigate these challenges in the coming years.

Market Segmentation

By Propulsion Type

- Battery Electric Vehicles (BEVs): Dominated the market in 2023, offering zero tailpipe emissions and aligning with India’s environmental goals.

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- Hybrid Electric Vehicles (HEVs)

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Others

By Component Type

- Battery Pack

- Electric Motors

- Power Electronics

- Electric Drivetrain

- Charging Infrastructure

- Others

By End-User

- Individual Consumers

- Fleet Operators

- Commercial Entities

- Government and Public Agencies

- Others

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/63133/

Regional Insights

- North India (NCR, Delhi, Noida, Gurugram): Strong EV adoption and production hubs; government incentives drive consumer demand.

- South India (Karnataka, Tamil Nadu, Telangana): Home to several EV startups, battery manufacturing plants, and research facilities; Bengaluru and Hyderabad serve as innovation hubs.

The country’s regional diversity in manufacturing and R&D activities ensures broad-based growth across the EV components ecosystem.

Competitive Landscape

Key players in India’s EV components market include:

- SEG Automotive India Pvt. Ltd. (Bengaluru)

- Tata Motors Ltd. (Mumbai)

- Mahindra Electric Mobility Ltd. (Bengaluru)

- Avtec Ltd. (Delhi)

- Exide Industries Ltd. (Kolkata)

- Bosch Ltd. (Bengaluru)

- Ashok Leyland (Chennai)

- Maruti Suzuki (New Delhi)

- Okaya Power Pvt. Ltd. (New Delhi)

- Amara Raja Batteries Ltd. (Andhra Pradesh)

Other notable players include Sparco Batteries, Eastman Auto & Power, Exicom Tele-Systems, Delta Electronics India, and Hero Electric Vehicles.

Conclusion

The India Electric Vehicle Components Market is on a strong growth trajectory, fueled by policy support, technological innovation, and rising environmental consciousness. While high initial costs and import dependencies remain challenges, domestic manufacturing initiatives, battery innovation, and supportive infrastructure are paving the way for a sustainable, cost-efficient, and technologically advanced EV ecosystem in India.