Asset-Based Lending Market: Growth Drivers, Trends, and Opportunities

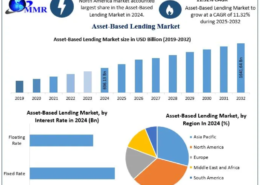

The Asset-Based Lending (ABL) Market is experiencing rapid growth, with a market size of USD 696.13 billion in 2024 and projected to reach USD 1,641.64 billion by 2032, growing at a CAGR of 11.32%. This growth reflects the increasing adoption of asset-backed financing as a flexible alternative to traditional lending solutions for businesses of all sizes.

Market Overview

Asset-Based Lending (ABL) is a form of financing where a borrower secures a loan using specific assets as collateral. Unlike traditional lending, which prioritizes creditworthiness, ABL evaluates the value and liquidity of assets such as accounts receivable, inventory, machinery, real estate, and equipment. Lenders determine the advance rate, a percentage of the asset’s appraised value, which dictates the loan amount—typically 80% for receivables and 50% for inventory, depending on liquidity and industry norms.

ABL allows businesses to leverage their balance sheet to access working capital, fund growth initiatives, acquire assets, manage cash flow, or restructure debt. By unlocking liquidity tied to tangible assets, companies can stabilize operations and maintain predictable cash flows, especially during periods of rapid growth or seasonal revenue fluctuations.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/189641/

Market Dynamics

Growth Drivers

- Increased Liquidity and Access to Capital

Asset-based financing enhances liquidity, offering companies a reliable funding source. This is particularly beneficial for small and medium-sized enterprises (SMEs), startups, or businesses with non-investment grade credit profiles. By consolidating financing into a single loan secured by collateral, businesses can access substantial funds without relying solely on cash flow or credit history. - Easier Qualification Compared to Traditional Loans

Unlike conventional bank loans, which require long credit histories, robust profitability, and strict financial covenants, ABL programs allow businesses to qualify based on the value of their assets. Accounts receivable, equipment, and inventory serve as common collateral, simplifying approval and expanding financing access. This flexibility is especially advantageous for SMEs and startups that often face barriers in accessing traditional funding. - SME Financing Opportunities

SMEs account for 90% of global businesses and more than 50% of employment, yet many struggle with financing, with an unmet funding need of USD 5.2 trillion annually. ABL enables SMEs to leverage receivables, inventory, and equipment as collateral, facilitating working capital access and business growth. Innovative financing solutions are vital in bridging this gap, particularly in regions like Latin America, the Middle East, and Africa, where financing gaps are largest.

Market Restraints

Regulatory and Compliance Challenges

ABL requires thorough asset appraisal, periodic monitoring, and compliance with financial regulations. For new entrants, the complex evaluation process and collateral management may present operational challenges. Additionally, fluctuations in asset values can affect borrowing limits, adding a degree of risk for both lenders and borrowers.

Market Trends

- Diversification of Collateral Types

ABL providers increasingly consider a wider range of assets, including machinery, stock, property, and receivables, creating customized financing packages. This comprehensive approach allows businesses to optimize capital structure while maximizing access to liquidity. - Technology Integration

ABL firms are leveraging digital platforms, AI, and automated processes to streamline collateral appraisal, risk assessment, and loan management. Technology enhances efficiency, reduces operational costs, and improves the borrower experience, positioning lenders for sustained growth. - Impact of COVID-19

The pandemic accelerated the demand for ABL as businesses with substantial inventories or receivables transitioned from traditional cash-flow-based loans to asset-backed credit facilities. Industries such as retail, wholesale, food & beverage, and equipment rental witnessed increased adoption, highlighting the resilience of ABL during economic disruptions.

Segment Analysis

By Type:

- Receivables Financing: Dominates the market due to the ability to convert invoices into immediate cash, improving liquidity and reducing payment risk.

- Inventory Financing: Provides capital for businesses with significant inventory holdings, aiding in working capital management and seasonal demand fluctuations.

- Equipment Financing: Enables companies to acquire or upgrade machinery without large upfront costs.

By End-User:

- SMEs: Hold a significant share due to limited access to traditional financing and reliance on asset-backed solutions for operational and growth funding.

- Large Enterprises: Utilize ABL selectively to optimize capital structure or supplement existing funding sources.

By Interest Rate:

- Fixed Rate

- Floating Rate

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/189641/

Regional Insights

North America leads the global ABL market, holding a 37.8% market share in 2024 and expected to grow at a CAGR of 10.12% through 2032. The region’s dominance is attributed to a mature financial sector, favorable regulatory frameworks, technological innovation, and a strong base of specialized lenders. Financial institutions in the region efficiently manage collateral, streamline loan processing, and adopt technology-driven solutions, enhancing market growth.

Europe, Asia Pacific, South America, and the Middle East & Africa are emerging markets with increasing adoption of asset-backed financing. SMEs in these regions are particularly likely to leverage ABL to overcome traditional lending constraints.

Key Market Players

Leading players in the Asset-Based Lending market include:

- Lloyds Bank

- Barclays Bank PLC

- Hilton-Baird Group

- JPMorgan Chase & Co

- Berkshire Bank

- White Oak Financial, LLC

- Wells Fargo

- Porter Capital

- Capital Funding Solutions Inc.

- SLR Credit Solutions

- Fifth Third Bank

- HSBC Holdings plc

- SunTrust Banks, Inc. (now Truist Financial Corporation)

- Santander Bank, N.A.

- KeyCorp

- BB&T Corporation (now Truist Financial Corporation)

- Goldman Sachs Group, Inc.

Conclusion

The Asset-Based Lending Market is poised for robust growth, driven by increased liquidity needs, simplified qualification criteria, SME financing demand, and technological integration. While regulatory compliance and asset valuation risks remain challenges, ABL offers a flexible, scalable, and reliable financing solution for businesses worldwide. By expanding collateral options and leveraging innovative technologies, lenders and businesses can capitalize on the growing opportunities in this dynamic market.