Container Fleet Market: Global Industry Outlook and Strategic Analysis (2024–2032)

Market Overview

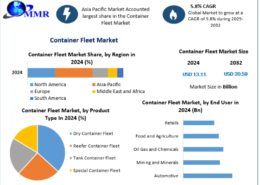

The global Container Fleet Market plays a pivotal role in enabling international trade by supporting the efficient movement of goods across continents. In 2024, the market was valued at USD 13.11 Billion, and it is projected to expand at a CAGR of 5.8% between 2025 and 2032, reaching approximately USD 20.59 Billion by the end of the forecast period.

Containerization has fundamentally transformed global logistics by introducing standardized cargo units that minimize handling time, lower transportation costs, and enhance supply chain reliability. This system has become indispensable for industries seeking scalable and cost-efficient transportation solutions in an increasingly interconnected global economy.

Key Growth Drivers

The rapid expansion of international trade and globalization remains the primary catalyst for container fleet market growth. As companies increasingly source materials and sell products across borders, the demand for dependable containerized transport continues to rise.

Additionally, the booming e-commerce sector has significantly amplified the need for container shipping, driven by consumer expectations for fast, reliable delivery across regions. Infrastructure modernization, port automation, and advancements in vessel design further support market expansion by improving cargo handling efficiency and turnaround times.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/35879/

Industry Trends and Innovations

The container fleet industry is undergoing a digital and operational transformation. One of the most prominent trends is the adoption of smart containers, equipped with IoT sensors and real-time tracking technologies. These innovations improve shipment visibility, monitor cargo conditions, and optimize route planning.

Sustainability has also become a central focus. Shipping companies are increasingly investing in fuel-efficient vessels, alternative fuels, and carbon-neutral fleet initiatives to comply with international environmental regulations and reduce emissions.

Market Dynamics

Freight Rate Volatility and Capacity Expansion

Container freight rates experienced extreme volatility during 2022, following unprecedented highs in late 2021. While rates remained elevated in early 2022, a sharp correction occurred by the third quarter, bringing prices closer to pre-pandemic levels by year-end. By early 2023, freight rates stabilized due to easing port congestion and improved supply-demand alignment.

Despite a modest decline in global containerized trade in 2022, container ship capacity increased by nearly 4%, raising concerns about potential oversupply. Continued vessel deliveries between 2023 and 2025 may intensify pricing pressure, particularly in spot freight markets.

Challenges Facing the Market

Oversupply remains one of the most pressing challenges for the container fleet industry. Excess vessel capacity, coupled with subdued trade demand, has led to declining freight rates and tighter profit margins.

Shipping operators also face rising financial pressure from high operating costs, debt burdens, and unpredictable demand cycles. In many cases, pricing power has shifted to customers, forcing fleet operators to operate at reduced margins or below breakeven levels.

Strategic Opportunities

Despite these challenges, the market presents notable opportunities. Companies are prioritizing fleet optimization, intermodal transportation solutions, and improved inventory planning to enhance asset utilization and profitability.

Operational efficiency, digital fleet management systems, and optimized warehouse integration are emerging as key strategies to counter shrinking margins and unlock long-term value. These initiatives highlight the evolving nature of the container fleet market and its resilience amid economic uncertainty.

Segment Analysis

By Product Type

- Dry Containers dominate the market and are expected to maintain leadership throughout the forecast period. Their versatility, affordability, and suitability for transporting a wide range of manufactured and consumer goods make them the backbone of global trade.

- Reefer Containers are essential for temperature-sensitive cargo such as food products and pharmaceuticals, offering precise climate control throughout transit.

- Tank Containers are widely used for transporting liquids and gases, particularly in chemical, petrochemical, and food industries, due to their high safety standards.

- Special Containers cater to niche cargo requirements and support specialized logistics operations.

The global tank container fleet has shown steady growth, with significant year-on-year increases in both fleet size and new unit production, led by a small group of dominant manufacturers accounting for the majority of global output.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/35879/

Regional Insights

Asia Pacific

Asia Pacific holds the largest share of the container fleet market, driven by rapid industrialization, export-oriented manufacturing, and increasing demand for intermodal freight solutions. Countries such as China, Japan, South Korea, and India play a critical role in shaping regional market growth. China, in particular, stands out as a major producer of container fleets and a leader in port and shipbuilding infrastructure development.

North America

North America remains a key market, supported by strong economic activity in the United States and Canada. Industries such as automotive, energy, and agriculture rely heavily on containerized transport for both domestic distribution and international trade, reinforcing the region’s importance in the global logistics ecosystem.

Competitive Landscape

The container fleet market is highly competitive, characterized by the presence of major global shipping lines and leasing companies. Industry leaders focus on strategic partnerships, fleet expansion, sustainability initiatives, and digital transformation to maintain market share.

Notable developments include investments in carbon-neutral vessels, fleet capacity expansion through ultra-large container ships, and rising leasing revenues driven by increased demand for container assets.

Market Scope and Coverage

- Base Year: 2024

- Forecast Period: 2025–2032

- Market Size (2024): USD 13.11 Billion

- Market Size (2032): USD 20.59 Billion

- CAGR: 5.8%

Segments Covered:

- By Product Type: Dry, Reefer, Tank, Special Containers

- By End User: Automotive, Mining & Minerals, Oil & Gas & Chemicals, Food & Agriculture, Retail

- By Region: Asia Pacific, Europe, North America, Middle East & Africa, South America

Conclusion

The global container fleet market remains a cornerstone of international trade, supporting complex supply chains across industries and regions. While short-term challenges such as oversupply and pricing pressure persist, long-term growth prospects remain strong, driven by globalization, digital innovation, and sustainability initiatives. Companies that prioritize operational efficiency, fleet optimization, and environmental responsibility are well-positioned to thrive in this evolving market landscape.