Automotive Coolant Market: Global Industry Outlook, Trends & Forecast (2024–2030)

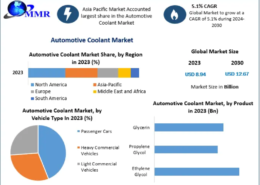

The Automotive Coolant Market, valued at USD 8.94 billion in 2023, is projected to rise steadily at a CAGR of 5.1%, ultimately reaching approximately USD 12.67 billion by 2030. With vehicle parc expanding, OEM production surging in Asia Pacific, and technological advances reshaping coolant formulations, the market is entering a phase of sustained long-term growth.

Market Overview

Automotive coolant—commonly referred to as antifreeze—is a specially engineered liquid designed to regulate engine temperature, prevent freezing or boiling, and protect internal metal components from corrosion. Typically available in green, blue, pink, or yellow formulations, coolants are produced using base fluids such as ethylene glycol, propylene glycol, or emerging bio-based alternatives like glycerine.

As modern vehicles become more powerful and compact, the thermal load on engines continues to rise. This has accelerated the adoption of high-performance coolants capable of dissipating heat efficiently while extending engine life and reducing maintenance needs. Additionally, the massive growth in SUV and light truck production—as seen particularly in Asia-Pacific—has strengthened demand from both OEM and aftermarket channels.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/11151/

Key Market Dynamics

- Rising Need for Eco-Friendly Coolants

Environmental regulations and concerns around ethylene-glycol toxicity have encouraged manufacturers to explore greener coolant solutions. Ethylene glycol, despite being affordable and efficient, is harmful if ingested by animals or humans. This has driven OEMs toward bio-derived alternatives and safer formulations with lower toxicity and improved biodegradability.

Innovations in vegetable-based coolants, glycerine blends, and renewable PDO (1,3-propanediol) are expanding the market’s sustainability profile. PDO-based coolants, in particular, offer stronger anti-corrosion capabilities and enhanced thermal performance, making them ideal for commercial vehicles and off-road applications.

- Rising EV Adoption Creates Market Challenges

Battery electric vehicles (BEVs) do not rely on conventional internal combustion engines and typically require fewer or different types of thermal management fluids. While EVs do use thermal fluids for battery cooling, they do not use standard engine coolants. This shift is slowly reducing the long-term demand for traditional coolant products, particularly in fully electric passenger cars.

However, the rapid global adoption of hybrid vehicles, which still rely on ICE components, helps to offset some of this decline.

- Recycling of Antifreeze Presents Both Opportunity & Challenge

Recycling used coolant is becoming increasingly important due to the presence of heavy metals such as chromium, cadmium, and lead in waste antifreeze. While coolant recycling helps reduce environmental impact, it presents technical and logistical challenges for manufacturers and service providers. Developing cost-effective recycling systems and high-purity distillation methods remains a crucial requirement for long-term industry sustainability.

Segment Analysis

By Vehicle Type

Passenger Cars hold the largest share of the global market. Several long-term trends support this dominance:

- Growth of SUV and crossover segments

- Rising private vehicle ownership in emerging economies

- Expansion of automotive manufacturing plants in India, China, and Southeast Asia

- Introduction of new OEM coolant formulations tailored for modern engines

This segment will continue to anchor coolant demand through 2030.

By Product Type

- Ethylene Glycol

- Still the dominant coolant base

- High thermal conductivity and cost-effectiveness

- Propylene Glycol

- Safer and less toxic

- Increasingly used in environmentally sensitive markets

- Glycerine (Emerging Leader)

Glycerine, a major by-product of biodiesel production, is gaining momentum due to:

- Renewable sourcing

- Competitive pricing

- Strong performance in thermal transfer

Research into nano-fluid–enhanced glycerine coolants aims to deliver improved heat dissipation, reduced corrosion, and reduced radiator size—leading to lower emissions and up to 5% fuel savings.

By Technology Type

Organic Acid Technology (OAT) is rapidly expanding due to:

- Longer service life

- Superior protection for aluminum-based components

- Strong resistance to corrosion

- Compatibility with modern engine designs

Hybrid OAT and inorganic coolants also hold steady demand, particularly in older and heavy-duty vehicles.

By End User

- OEMs increasingly deliver vehicles with long-life, factory-filled coolants, reflecting improvements in formulation quality.

- Aftermarket demand remains strong due to periodic replacement cycles and increasing road mileage.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/11151/

Regional Insights

Asia Pacific – The Global Growth Engine

Asia Pacific is poised to remain the largest and fastest-growing region. Key drivers include:

- Massive vehicle production in China, India, Japan, Thailand, and South Korea

- Lower labor and manufacturing costs

- Rapid industrialization and infrastructure expansion

- Rising SUV and commercial vehicle penetration

India, in particular, stands out due to:

- Being one of the world’s largest commercial vehicle producers

- Expansion of local coolant manufacturing

- Increased crude oil refining, boosting ethylene glycol availability

These factors help position India as a major future exporter of automotive coolants.

North America & Europe

These regions maintain steady demand with:

- Strong aftermarket activity

- High population of older vehicles requiring coolant replacement

- Growing preference for eco-friendly coolants

Europe, with its strict emissions regulations, is especially receptive to biodegradable and long-life coolants.

Competitive Landscape

The market is moderately consolidated, with key multinational brands focusing on product innovation, expansion of regional manufacturing, and partnerships with OEMs. Prominent firms include:

- Castrol Limited

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- Sinopec Lubricant Company

- TotalEnergies

- Valvoline

- Chevron Corporation

- Motul

- Petronas

- Amsoil Inc.

- Kost USA

- Lukoil

Competition is intensifying around developing sustainable, long-life, and high-performance coolant technologies.

Future Outlook

The automotive coolant industry is undergoing a transformation shaped by:

- Growing demand for high-efficiency cooling systems

- Stricter regulatory environments

- Transition towards sustainable, low-toxicity formulations

- Rising vehicle production in emerging markets

While electrification introduces certain long-term risks for traditional coolant categories, hybrid vehicle growth and innovations such as nano-fluid coolants, advanced OAT formulations, and renewable glycerine coolants are expected to unlock new opportunities.

By 2030, coolants will be defined not just by thermal performance but by sustainability, recyclability, and compatibility with next-generation mobility technologies.