Global Distributed Antenna Systems Market: Enabling Seamless Connectivity in a 5G-Driven World

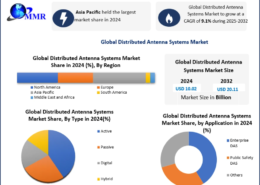

The Global Distributed Antenna Systems (DAS) Market is witnessing steady growth as demand for reliable, high-capacity wireless connectivity continues to rise across densely populated and infrastructure-intensive environments. Valued at USD 10.02 billion in 2024, the market is projected to grow at a CAGR of 9.1% from 2025 to 2032, reaching approximately USD 20.11 billion by 2032. This expansion reflects the increasing reliance on mobile data, the rapid rollout of 5G networks, and the growing need for seamless indoor and outdoor wireless coverage.

Market Overview

Distributed Antenna Systems are networks of spatially separated antenna nodes connected to a common signal source, designed to enhance wireless signal strength and coverage over large or complex areas. DAS solutions are widely deployed in stadiums, airports, hospitals, office complexes, shopping malls, transportation hubs, and smart buildings, where traditional macro cell towers struggle to deliver consistent coverage.

The rising adoption of smartphones, IoT devices, and bandwidth-intensive applications has placed unprecedented pressure on wireless networks. DAS addresses these challenges by improving network capacity, minimizing dead zones, and ensuring reliable connectivity—particularly in high-density urban environments. Regulatory mandates for public safety communications and emergency responder coverage are further accelerating DAS deployments globally.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/7768/

Key Growth Drivers

Expanding 5G and IoT Ecosystems

The global rollout of 5G networks is a major catalyst for DAS adoption. High-frequency 5G signals, while offering superior speed and low latency, have limited penetration capabilities indoors. DAS solutions optimized for multi-band and 5G connectivity are therefore essential to ensure consistent coverage. Technologies such as Ericsson’s Radio Dot System demonstrate how DAS can seamlessly integrate with modern cellular architectures to enhance indoor network performance.

At the same time, the proliferation of IoT-enabled smart buildings is driving demand for scalable and robust connectivity infrastructure. DAS enables continuous wireless access for applications such as energy management, indoor navigation, asset tracking, and building automation, making it a foundational component of smart infrastructure.

Rising Data Traffic and High-Density Venues

Exponential growth in mobile data traffic—driven by video streaming, cloud services, and real-time applications—has increased the need for high-capacity wireless systems. High-density venues such as stadiums, airports, and convention centers are increasingly relying on DAS to support thousands of simultaneous connections. Deployments like AT&T’s DAS installation at major sports stadiums highlight the importance of reliable coverage during peak usage events.

Industry Innovation and Strategic Partnerships

Leading DAS providers are actively investing in research and development, strategic partnerships, and acquisitions to enhance system performance and flexibility. Companies such as CommScope, Corning Incorporated, and Cobham Wireless are introducing advanced DAS platforms capable of supporting multiple frequency bands, higher data rates, and seamless integration with Wi-Fi 6, edge computing, and cloud-based network management solutions. Collaboration between telecom operators and DAS vendors is becoming increasingly common to deliver end-to-end wireless solutions.

Market Challenges

Despite strong growth prospects, the DAS market faces notable challenges. High deployment costs and long installation timelines remain significant barriers, particularly for complex venues. DAS systems often rely on fiber-optic infrastructure and customized designs, increasing both material costs and implementation time. The process from carrier approval to final deployment can take six months or longer.

Additionally, compatibility issues with legacy systems complicate seamless integration. Designing DAS architectures that are future-proof requires close coordination between wireless service providers and system designers to accommodate evolving traffic demands, new frequency bands, and technologies such as MIMO. Venue-specific constraints—including building materials, layout, and aesthetic requirements—further add to deployment complexity.

Segment Analysis

By Product Type

Active DAS dominated the market in 2024, owing to its ability to support high-capacity and large-scale deployments through fiber-optic signal distribution and amplification. It is widely used in airports, stadiums, and large commercial complexes.

Passive DAS offers a cost-effective alternative for smaller indoor environments, using coaxial cables without signal amplification.

Digital DAS leverages advanced signal processing to deliver superior performance in high-density indoor settings such as malls and convention centers.

Hybrid DAS combines active and passive elements, providing flexibility and scalability for diverse applications, including healthcare facilities and university campuses.

By Application

The Enterprise DAS segment accounted for the largest share of the market in 2024. Enterprises across office buildings, retail spaces, hotels, educational campuses, and mixed-use developments are investing heavily in DAS to eliminate signal dead zones and ensure uninterrupted connectivity. The growing dependence on mobile devices and 4G/5G-enabled applications has made high-quality indoor coverage a business-critical requirement.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/7768/

Regional Insights

Asia Pacific Leads the Global Market

The Asia Pacific region dominates the global DAS market, with China emerging as the leading contributor. China’s strong telecom ecosystem, large population base, and aggressive investments in 5G infrastructure have created substantial demand for DAS solutions. Major technology companies such as Tencent, Baidu, and Alibaba continue to invest heavily in next-generation connectivity, AI, and IoT under the government’s “new infrastructure” initiatives.

The integration of 5G and IoT technologies is further driving DAS adoption across enterprises, enabling efficient management of connected devices and scalable network operations. As data traffic continues to rise, demand for DAS solutions in China and the broader Asia Pacific region is expected to remain strong.

Competitive Landscape

The Distributed Antenna Systems market is moderately competitive, with global and regional players focusing on innovation, customization, and strategic alliances. Key companies operating in the market include CommScope, Corning Incorporated, AT&T, JMA Wireless, Ericsson, Huawei, Comba Telecom, SOLiD, HUBER+SUHNER, and TE Connectivity. These players are expanding their portfolios to address evolving connectivity requirements across industries.

Outlook

The Global Distributed Antenna Systems Market is positioned for sustained growth as wireless connectivity becomes increasingly central to modern infrastructure. The convergence of 5G, IoT, smart buildings, and data-intensive applications is expected to keep demand strong throughout the forecast period. While cost and integration challenges persist, ongoing technological advancements and collaborative deployment models are likely to improve affordability and scalability, reinforcing DAS as a critical enabler of next-generation wireless communication.